Download KSS Prasad Excel Income Tax Software FY 2023-24

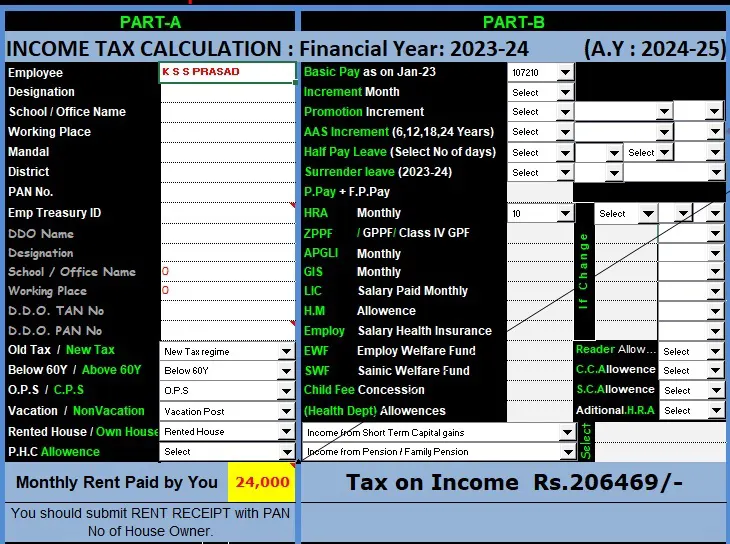

KSS Prasad IT Software FY:2023-24: KSS Prasad has released latest AP KSS Prasad Income Tax Software for the financial year FY:2024-25. His Income Tax latest Excel software is popular as Seshadri Income Tax and very easy to calculate Income Tax for the employees of AP. The KSS Prasad AP IT software consist Data Sheet, Salary Form, Annexure-II form, Rent receipt. AP Govt. Employees can download KSS Prasad Income Tax Excel Software FY:2023-24 from our website and make use for the calculation of income tax. The software clearly follows 80C Deductions as well as beyond 80C Deductions.

Here, we provide direct link to download KSS Prasad Income Tax Software. AP Govt. employees can download the KSS Prasad IT Excel Software. After downloading the software, first fill the all data Name, Designation, Basic Pay, Increment, and Deductions in the Data sheet. Once you have done to fill all data in the Data Sheet and take printout of Salary Sheet, Annexure-II, Form-16, Rent receipt. After taking all prints, submit the same to the DDO.

Download KSS Prasad Income Tax Software FY:2023-24 Click Here

Overview of KSS Prasad Income Tax(IT) Software FY:2023-24

Here, we are providing overview on KSS Prasad Income Tax Software for the Financial year 2023-24.

| Name of the Article | KSS Prasad Income Tax Software FY:2023-24 |

| Name of the Developer | KSS Prasad |

| Used Plot form | Microsoft Excel |

| Date of Release of Software | 24th January 2024 |

| Forms Available in Software | Salary Sheet, Annexure-II, Form-16, Rent Receipt |

| Financial Year | FY:2023-24 |

| Direct Download Link | www.apteacher.net |

New Tax Regime Revised Income Tax Slabs FY 2023–24

KSS Prasad IT AP Employees software has prepared based on the slabs mentioned here. Income Tax Slab categorizes individual taxpayers based on their income, determining the applicable tax rates. Higher incomes correspond to higher tax payments. The slab system ensures a fair tax structure and undergoes changes with each budget announcement.

- Up to Rs.3 lakh – 0% (Nil)

- Rs. 3 lakh to Rs. 6 lakh – 5%

- Rs. 6 lakh to Rs. 9 lakh – 10%

- Rs. 9 lakh to Rs. 12 lakh – 15%

- Rs. 12 lakh to Rs. 15 lakh – 20%

- Above Rs. 15 lakh – 30%

Salient Features in KSS Prasad Income Tax Software

- Software is made up using MS Excel.

- It has Data sheet to fill all requisite DATA.

- It has Salary Sheet, IT Calculation Sheet, Form-16, Rent Receipt.

- All forms can download and take print it.

You may also like

- Seshadri Online Mobile, Desktop Version Income Tax Software FY Click Here

- Seshadri Excel Income Tax Software Click Here

Tax Calculated in KSS Prasad Income Tax software in New Regime

The KSS Prasad Income Tax software is prepared based on the New Tax regime following here.

| Tax Slab | Rates |

|---|---|

| Up to Rs. 3,00,000/- | NIL |

| Rs. 300,000/- to Rs. 6,00,000/- | 5% on income which exceeds Rs 3,00,000/- |

| Rs. 6,00,000/- to Rs. 900,000/- | Rs 15,000 + 10% on income more than Rs 6,00,000/- |

| Rs. 9,00,000 to Rs. 12,00,000/- | Rs 45,000 + 15% on income more than Rs 9,00,000/- |

| Rs. 12,00,000 to Rs. 1500,000/- | Rs 90,000 + 20% on income more than Rs 12,00,000/- |

| Above Rs. 15,00,000/- | Rs 150,000 + 30% on income more than Rs 15,00,000/- |

Section 24, 80EE & 80EEA Housing loan Interest Tax Deduction Clarification

Section 80EEA Eligibility Criteria

Additional deduction amounting to Rs 1,50,000 is allowed in addition to deduction under section 24(b). Loan should be sanctioned between 1 April 2019 and 31 March 2022.

Stamp duty value of the house should not exceed Rs 45 lacs. Carpet area of the house should not exceed 60 sqmtr in metro cities and 90 sqmtr in other cities.

Eligibility Criteria of Section 80EE

Individual taxpayers who have bought a house for the first time and taken a home loan can claim the tax deduction benefit under section 80EE. Value of the house should be Rs.50 lakh or less.

Home loan availed should be Rs.35 lakh or less. Deduction limit is up to Rs. 50,000 per annum and only available on the interest paid for the home loan. Loan should be sanctioned by a recognized financial institution and disbursed during the period between April 2016 to March 2017.

80 EE వర్తింపు నిబంధనలు

1. హోమ్ లోన్ బ్యాంక్ ల నుండి లేదా హౌసింగ్ ఫైనాన్సు కంపెనీల నుండి తీసుకుని ఉండాలి.

2. లోన్ FY 2016 -17 (01.04.2016 నుండి 31.03.2017 మధ్య) లో మాత్రమే తీసుకుని ఉండాలి.

3. వారి పేరిట కేవలం ఈ ఒక్క ఇల్లు మాత్రమే ఉండాలి.

4. వారు ఈ ఇంటి నిర్మాణం కోసం తీసుకున్న రుణం 35లక్షలు లేదా 35లక్షల లోపు ఉండాలి

5. ఇట్టి ఇంటి విలువ (ప్రభుత్వ విలువ) 50లక్షలు లేదా 50లక్షల లోపు ఉండాలి.

80 EEA వర్తింపు నిబంధనలు

1. లోన్ బ్యాంక్ ల నుండి లేదా హౌసింగ్ ఫైనాన్సు కంపెనీల నుండి తీసుకుని ఉండాలి.

2. లోన్ FY 2019 -20 (01.04.2019 నుండి 31.03.2020 మధ్య) లో మాత్రమే తీసుకుని ఉండాలి.

3. వారి పేరిట కేవలం ఈ ఒక్క ఇల్లు మాత్రమే ఉండాలి.

4. రిజిస్ట్రేషన్ కోసం ఇంటి విలువ (ప్రభుత్వ విలువ) 45లక్షలు లేదా 45లక్షల లోపు విలువ ఉన్న ఇంటికి స్టాంప్ డ్యూటీ చెల్లించి ఉండాలి.

Income Tax Online Software for AP and Telangana FY:2023-24

- Income Tax Online Software for AP Employees FY:2022-23 Click Here

- Income Tax Online Software for Telangana Employees FY:2022-23 Click Here

Comparison of New Vs Old Tax Regime

| Particulars | Old Tax Regime | New Tax regime (until 31st March 2023) |

New Tax Regime (From 1st April 2023) |

| Income level for rebate eligibility | ₹ 5 lakhs | ₹ 5 lakhs | ₹ 7 lakhs |

| Standard Deduction | ₹ 50,000 | – | ₹ 50,000 |

| Effective Tax-Free Salary income | ₹ 5.5 lakhs | ₹ 5 lakhs | ₹ 7.5 lakhs |

| Rebate u/s 87A | 12,500 | 12,500 | 25,000 |

| Standard Deduction (Rs 50,000) | Yes | No | Yes |

| Interest on Home Loan u/s 24b on let-out property | Yes | Yes | Yes |

| Employer’s contribution to NPS | Yes | Yes | Yes |

Download Other Income Tax Software

- Income Tax Online Software for AP Employees FY:2022-23 Click Here

- Income Tax Online Software for Telangana Employees FY:2022-23 Click Here

- Seshadri Income Tax Software FY 2022-23(AY : 2023-24) Click Here

- KSS Prasad Income Tax Software FY 2022-23 Click Here

- C Ramanjaneyulu Income Tax Software Click Here

Download All Financial Years KSS Prasad Income Tax

- KSS Prasad Income Tax Software FY: 2023-24 Click Here

- KSS Prasad Income Tax Software FY:2022-23 Click Here

- KSS Prasad Income Tax Software FY:2020-21 Click Here

FAQs of KSS Prasad Income Tax Software

Question: Where can I download KSS Prasad Income Tax Software ?

Ans: KSS Prasad Income Tax Excel software can download from www.apteacher.net .

Question: Is it useful to new tax regime ?

Ans: Yes, It’s useful to New Tax Regime as well as old Tax Regime.

Question: Is the KSS Prasad Income Tax Software is mobile friendly ?

Ans. The software is not mobile friendly. For mobile friendly software, you can use seshadri income tax online software.

Question: What are the forms available in KSS Prasad Income Tax Software ?

Ans: Salary Sheet, IT Calculation Form, Form-16 in printable form.

Question: Is option available for Below 6o years age, Above 60 years Age ?

Ans. Yes, Both options available at KSS Prasad Income Tax Software, FY:2023-24.