Latest KSS Prasad Income Tax(IT) Software Excel FY:2025-26 Download AP

Read Also

- Seshadri Online Income Tax Software for AP A4 Printable Click Here

- Seshadri Income Tax Software FY 2025-26(AY : 2026-27) Click Here

- KSS Prasad Income Tax Software FY 2025-26 Click Here

| Name of the Article | KSS Prasad Income Tax Software FY:2025-26 |

| State | Andhra Pradesh |

| Name of the software | Income Tax Excel Software 2025-26 |

| Useful for | To Calculate tax of AP Employees |

| Software Designer | KSS Prasad |

| Financial Year(FY) | 2025-26 |

| Assessment Year(AY) | 2026-27 |

| KSS Prasad Software available at | www.apteacher.net |

| Forms available at software | Annexure-II, Salary Form, Form16, Rent Slip |

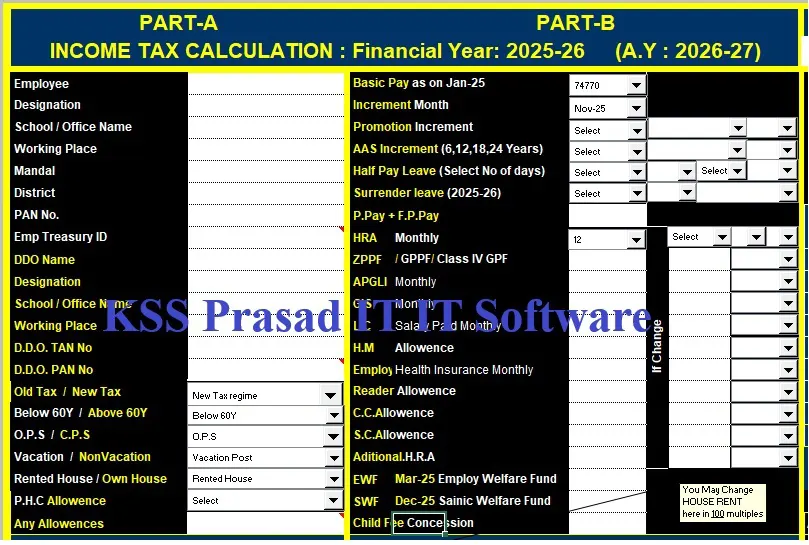

KSS Prasad Gunturbadi IT 2025-26 Calculations Salary Sheet (Annexure-I) and Annexure-II

Salary Sheet (Annexure-I), Income Tax Calculation Sheet (Annexure-II) are available in the KSS Prasad Income Tax Excel Software which are all in A4 and Printable. He has inserted FORM-16, Rent Slip in the AP Income Tax Software. He clearly mentioned every field in he IT Form which one can be easily identified.

Download KSS Prasad Income Tax Software FY:2025-26 Click Here

KSS Prasad IT Fill Data Sheet to Get Full Details

AP Govt Employees can download the KSS Prasad IT Software 2025-26 in the following link. After downloading the software data has to enter in the Data Sheet carefully. Data sheet consists Employee Personal Details, Salary Details, 80C Deductions with Specified Limits and beyond 80C deductions like Home Lone Interest, Education Loan Interest, EWF,SWF.

Things to Keep in Mind While Preparing Income Tax

It is advisable before going to fill in the data sheet, first read the instructions which are specified in the welcome sheet. The welcome sheet specified clearly how to use the IT Excel Software. In the welcome page he has requested to the users to use original copy of Income Tax Software and should not use once used.

More Useful IT Calculation to AP Govt Employees

The salaried persons of AP Govt. Employees can use his Income Tax Software with an ease. After filling the data with Basic Pay, Increments along with 80C deductions once take printouts in A4 sheets and same can be submitted to DDO who is responsible person to deduct Income Tax.

Special Features in KSS Prasad IT Software 2025-26

- Data Sheet is more intuitive and easier to understand.

- Data fields are in hierarchical order.

- Required fields are in white background to use more easily.

- Annexure-I, Annexure-II, Form-16, Rent Receipt are in A4 Sheets can take printouts.

- Space for advance tax deductions is available.

List of Income Tax Software FY:2025-26 for AP Employees to Download

Employees of Andhra Pradesh can download various Income Tax software products given below and make use of it.

| S No | Name of the Income Tax Software FY: 2025-26 | Updated On | Download Link |

|---|---|---|---|

| 1 | #1 Seshadri Income Tax Online Software | 08/02/2026 | Click Here |

| 2 | Seshadri Income Tax Software | 08/02/2026 | Click Here |

| 3 | KSS Prasad IT Software | 03/02/2026 | Click Here |

| 4 | K Vijay Kumar IT Software | 03/02/2026 | Click Here |

| 5 | M Jayaram IT Software | 18/01/2026 | Click Here |

| 6 | B S Chari Software | 18/01/2026 | Click Here |

| 7 | K Sampath IT Software | 18/01/2026 | Click Here |

| 8 | C Ramanjineyulu Income Tax Software | 18/01/2026 | Click Here |

Read Also : Income Tax Slabs & Rates FY 2025-26

New Income Tax Slab Rates in Regime FY:2025-26

| New Income Tax Slabs for FY 2025-26 (AY 2026-27) | New Income Tax Rate for FY 2025-26 (AY 2026-27) |

| Up to Rs. 4,00,000 | NIL |

| From Rs. 4,00,001 to Rs. 8,00,000 | 5% |

| From Rs. 8,00,001 to Rs. 12,00,000 | 10% |

| From Rs. 12,00,001 to Rs. 16,00,000 | 15% |

| From Rs. 16,00,001 to Rs. 20,00,000 | 20% |

| From Rs. 20,00,001 to Rs. 24,00,000 | 25% |

| Above Rs. 24,00,001 | 30% |

List of Income Tax Software FY:2024-25 for AP Employees to Download

Employees of Andhra Pradesh can download various Income Tax software products given below and make use of it.

| S No | Name of the Income Tax Software, FY 2024-25 | Updated On | Download Link |

|---|---|---|---|

| 1 | #1 Seshadri Income Tax Online Software | 11/02/2025 | Click Here |

| 2 | Seshadri Income Tax Software Excel | 11/02/2025 | Click Here |

| 3 | M Jayaram Income Tax Software(Final) | 05/02/2025 | Click Here |

| 4 | C Ramanjaneyulu Income Tax Software | 05/02/2025 | Click Here |

| 5 | K Vijaya Kumar Income Tax Software | 05/02/2025 | Click Here |

| 6 | KSS Prasad Income Tax Software | 05/02/2025 | Click Here |

| 7 | B.S Chari Income Tax Software | 05/02/2025 | Click Here |

| 8 | Ch Nagendra Income Tax Software | 05/02/2025 | Click Here |

Download Links to KSS Prasad Income Tax Software

| S No | Name of the IT Software | Financial Year | Download Link |

| 1 | KSS Prasad IT Software FY 2024-25 | FY 2024-25(AY 2025-26) | Click Here |

| 2 | KSS Prasad IT Software FY 2023-24 | FY 2023-24(AY 2024-25) | Click Here |

| 3 | KSS Prasad IT Software FY 2022-23 | FY 2022-23(AY 2023-24) | Click Here |

| 5 | KSS Prasad IT Software FY 2021-22 | FY 2021-22(AY 2022-23) | Click Here |

| 6 | KSS Prasad IT Software FY 2020-21 | FY 2020-21(AY 2021-22) | Click Here |

Download FY 2024-26 Income Tax Software

- Seshadri Income Tax Software FY:2024-25 Click Here

- KSS Prasad Income Tax Software FY:2024-25 Click Here

- KSS Prasad Income Tax Software FY 2023-24 Click Here

- Seshadri Income Tax Software FY 2023-24(AY : 2024-25) Click Here

- AP Govt. Employees Online Income Tax Calculation FY:2022-23 Click Here

- C Ramanjaneyulu Income Tax Software FY:2022-23 Click Here

What is Exemption of House Rent Allowance, How to Calculate it ?

A salaried individual having a rented accommodation can get the benefit of HRA (House Rent Allowance). This could be totally or partially exempted from income tax. However, if you aren’t living in any rented accommodation and still continue to receive HRA, it will be taxable.

If you couldn’t submit rent receipts to your employer as proof to claim HRA, you can still claim the exemption while filing your income tax return. So, please keep rent receipts and evidence of any payment made towards rent. You may claim the least of the following as HRA exemption.

- Total HRA received from your employer

- Rent paid less 10% of (Basic salary +DA)

- 40% of salary (Basic+DA) for non-metros and 50% of salary (Basic+DA) for metros

How to deduct Standard Deduction Rs.50,000/- Under Section 16(ia) ?

These are the portions of your income or salary that are exempt from taxation. Your tax liability may be lowered thanks to these deductions. Everyone who receives a salary is eligible to claim these deductions, regardless of the category. The 2019 interim budget increased tax benefits for salaried person, one of the biggest changes was the increase in the standard deduction from Rs. 40,000/- to Rs 50,000/-. The New Tax Regime was implemented in 2020, although it is up to the taxpayer to decide whether to file their claims under the New Tax Regime or the Old Tax Regime.

The New Tax Regime FY:2023-24

The new tax regime offers six tax slabs, with zero tax for income up to ₹3 lakh, and a tax rate rising by 5 percentage points for incremental income of ₹3 lakh each.

| On Income | Tax Rate |

|---|---|

| Up to ₹ 3,00,000 | Nil |

| From ₹ 3,00,001 to ₹ 6,00,000 | 5% |

| From ₹ 6,00,001 to ₹ 9,00,000 | 10% |

| From ₹ 9,00,001 to ₹ 12,00,000 | 15% |

| From ₹ 12,00,001 to ₹ 15,00,000 | 20% |

| Above ₹ 15,00,000 | 30% |

The Old Tax Regime FY 2023-24

The income tax slabs were not tweaked for the old tax regime for FY 2023-24 and remain as below.

| Total Income | Tax Rate |

|---|---|

| Up to ₹ 2,50,000 | 0% |

| ₹ 2,50,000 to ₹ 5,00,000 | 5% |

| ₹ 5,00,000 to ₹ 10,00,000 | 20% |

| Above ₹ 10 lakh | 30% |

Section 80C, 80CCC and 80CCD(1)

The method for reducing taxes most frequently employed is Section 80C. An Individual or HUF (Hindu Undivided Families) can claim a tax deduction of up to Rs. 1.5 lakh in this case if they invest in or spend money on the designated tax-saving avenues. To encourage people to save and invest for retirement, the Indian government also promotes a few financial products as tax-saving instruments (PPF, NPS, etc.).

Some of investments are given below which are eligible for an exemption under Section 80C, 80CCC and 80CCD(1) up to a maximum of Rs 1.5 lakh.

- Life insurance premium

- Equity Linked Savings Scheme (ELSS)

- Employee Provident Fund (EPF)

- Annuity/ Pension Schemes

- Principal payment on home loans

- Tuition fees for children

- Contribution to PPF Account

- Sukanya Samriddhi Account

- NSC (National Saving Certificate)

- Fixed Deposit (Tax Savings)

- Post office time deposits

- National Pension Scheme

Medical Insurance Deduction (Section 80D)

Section 80D is a deduction you can claim on medical expenses. One can save tax on medical insurance premiums paid for the health of self, family and dependent parents. The limit for Section 80D deduction is Rs 25,000 for premiums paid for self/family. For premiums paid for senior citizen parents, you can claim deductions of up to Rs 50,000. Additionally, health checkups to the extent of Rs 5,000 are also allowed and covered within the overall limit.

Interest on Home Loan (Section 80C and Section 24)

You got home loan from a bank ? Premium and Interest paid are coming under tax saving. Homeowners have the option to claim up to Rs. 2 lakh as a deduction for interest on home loan for self-occupied property. If the house property is let out, you can claim a deduction for the entire interest pertaining to such a home loan. In addition to the above, one can also claim the principal component of the housing loan repayment as a deduction under 80C up to a maximum limit of Rs 1.5 lakh.

Deduction for Loan for Higher Studies (Section 80E)

Income Tax Act, 1961 provides a deduction for interest on education loans. The significant conditions attached to claiming such deduction are that the loan should have been taken from a bank or a financial institution for pursuing higher studies (in India or abroad) by the individual himself or his spouse or children. One may begin claiming this deduction beginning from the year in which the loan starts getting repaid and up to the next seven years (i.e. total of 8 assessment years) or before repayment of the loan, whichever is earlier. Even a legal guardian could avail this income tax deduction.

Deduction for Donations (Section 80G)

Section 80G of the Income Tax Act, 1961 offers income tax deduction to an assessee, who makes donations to charitable organizations. This deduction varies based on the receiving organization, which implies that one may avail deduction of 50% or 100% of the amount donated, with or without restriction.

Deduction on Savings Account Interest (Section 80TTA)

Section 80TTA of the Income Tax Act, 1961 offers a deduction of up to INR 10,000 on income earned from savings account interest. This exemption is available for Individuals and HUFs.

In case the income from bank interest is less than INR 10,000, the whole amount will be allowed as a deduction. However, in case the income from bank interest exceeds INR 10,000, the amount after that would be taxable.

FAQs on KSS Prasad Income Tax Software

Question: How much maximum deduction is allowed U/s 80C ?

Ans: Deductions on various investments and expenditure Rs 1.5 lakh is allowed per year from taxable income.

Question : Is HRA taxable in new tax regime ?

Ans: In new tax regime, you are not allowed to claim HRA as tax exemption.

Question : What is Section 80G in Income Tax ?

Ans: 80G of Income Tax Act is contributions made to certain relief funds and charitable institutions. Only donations made to certain funds are qualified under this section. Any taxpayer i.e individuals, companies, firms can avail tax deduction under this section. The maximum tax deduction is allowed 10% of gross total income.

Question : Is standard deduction Rs.75,000/- allowed under new tax regime ?

Ans: No, You can’t claim standard deduction Rs.75,000/- in new tax regime. Major deductions and exemptions are not allowed in the new tax regime.

Question : What is 80E of Income Tax section ?

Section 80E of Income Tax Act deals with tax deduction made for eductional loan interest for self and depedent. No tax benefit is available for the principle part of eductional loan.

Question: What functionality does KSS Prasad Income Tax Software for FY 2025-26 AY 2026-27 offer?

Ans: KSS Prasad Income Tax Software serves as a tool tailored for AP Govt. employees, facilitating the computation of their income tax. It encompasses a Data Sheet, Salary Form, Annexure-II form, and Rent receipt.

Question:How can one acquire KSS Prasad Income Tax Software for FY 2025-26?

Ans: The software can be obtained by visiting our website and using the provided direct link. Look for the dedicated link corresponding to the FY 2025-26 version.

Question: What details are required for completion in the Data Sheet?

Ans: The Data Sheet necessitates the inclusion of information such as Name, Designation, Basic Pay, Increment, and Deductions. It is imperative to input accurate and current data.

Question: What types of documents can be generated using KSS Prasad Income Tax Software?

Ans: Upon entering data in the Data Sheet, users can generate the Salary Sheet, Annexure-II, Form-16, and Rent receipt.

Question: What is the recommended course of action after obtaining all the printed documents?

Ans: Submit the printed documents, which include the Salary Sheet, Annexure-II, Form-16, and Rent receipt, to the DDO (Drawing and Disbursing Officer).

Question: Does the software encompass deductions beyond 80C?

Ans: Yes, KSS Prasad Income Tax Software comprehensively covers both 80C Deductions and deductions beyond 80C.

Question: Is the software known for its user-friendly interface?

Ans: Certainly, the software is renowned for its user-friendly nature, simplifying the income tax calculation process for AP Govt. employees.

Question: Where can one locate the direct link for downloading KSS Prasad Income Tax Software?

Ans: The direct link for AP Govt. employees to download the KSS Prasad IT Excel Software for FY 2023-24 is provided on our website.

Question: How can KSS Prasad Income Tax Software for FY 2025-26 be found?

Ans: Go to apteacher.net and find the KSS Prasasd Income Tax Link

Question: What is the process for downloading KSS Prasad Income Tax Software?

Ans: Visit apteacher.net or Medakbadi website and search on the Home Page to find the Xcel File Download option for KSS Prasad Income Tax Software.

Download KSS Prasad Income Tax Software Year wise

| S No | KSS Prasad Income Tax Software Financial Year | Download Link |

|---|---|---|

| 1 | FY 2024-25(AY: 2023-24) | Click Here |

| 2 | FY 2023-24(AY: 2024-25) | Click Here |

| 3 | FY 2022-23(AY: 2023-24) | Click Here |

| 4 | FY 2021-22(AY: 2022-23) | Click Here |

| 5 | FY 2020-21(AY: 2022-23) | Click Here |

very nice and easy to understand

SOFT WARE IS NOT OPENING PLEASE RECTIFY I AM AMARNATH REDDY

Sure Okie

Thank you sir

Thq Dr P Chaitanya Sankar 4 ur comment

Excellent article. I certainly appreciate this site. Keep writing!

Thq