Latest Income Tax Slabs Rates FY 2025-26 Union Budget 2026

Good news for all salaried persons and who are paying tax. The Govt. has increased standard deduction in the Budget 2026 upto Rs.75,000/- from 50,000/-. This move allows getting relief upto Rs.75000/- under new regime. Moreover, tax slab rates also changed, which is big relief to salaried taxpayers. Here, we are providing comprehensive details of new tax slab rates as well as increase of standard deductions which present in Budget 2026.

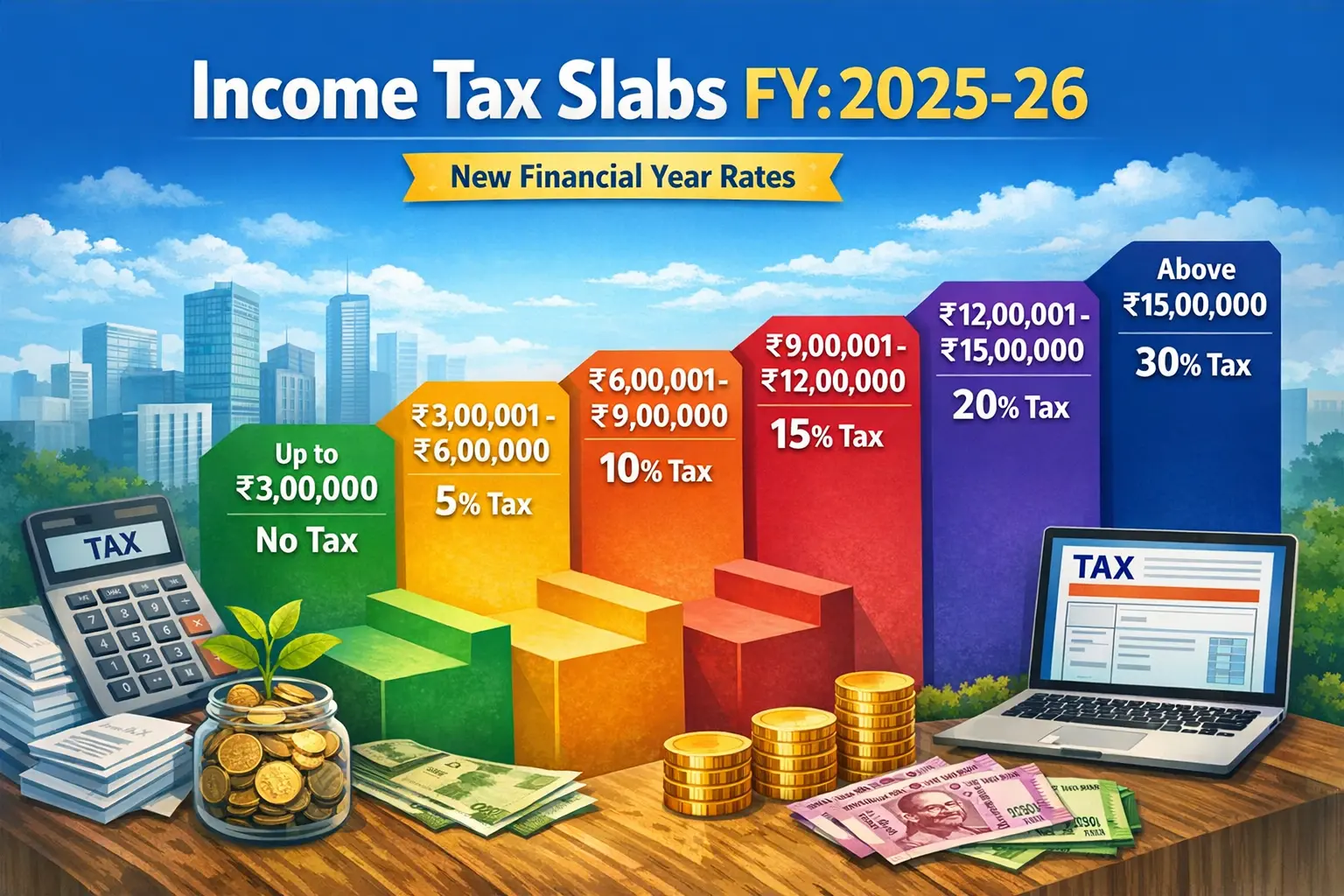

Income Tax Slabs FY 2025-26: Tax levied on income earned by all Individual, HUF etc is Income Tax. Tax on net taxable income is based on income tax slabs and rates for the financial year(FY) 2025-26 and for the assessment year(AY) 2026-27. Net taxable income is calculated after certain 80C deductions and beyond 80C deductions from the gross income. As per the Union Budget 2026 the slab rates in New tax regime and Old Tax Regine is as follows.

Read Also: AP Income Tax TDS Online Software FY: 2025-26 Click Here

Here we are providing present tax slab rates for FY 2025-26(AY 206-27), take a close look at revised income tax slabs and type of income and some main differences between the new and old tax regime.

New Tax Regime Slab Rates Changed, Standard Deduction Rs.75,000/-

Individuals and HUFs can opt for the Existing Tax Regime or the New Tax Regime with lower rate of taxation (u/s 115 BAC of the Income Tax Act). The taxpayer opting for concessional rates in the New Tax Regime will not be allowed certain Exemptions and Deductions (like 80C, 80D,80TTB, HRA) available in the Existing Tax Regime. Only standard deduction Rs.75,000/- is allowed in new tax system

| Name of the Article | Income Tax FY:2025-26(AY:2026-27) Tax Slabs |

| Applicable | All States in India |

| Financial Year of Tax | FY: 2025-26 |

| Type of the Tax Levied | Salaried Employees Personal Income Tax 2025-26 |

| Name of Tax Regimes | New Tax Regime as well As new Tax Regime |

| Best IT Software for Calculation | Online Income Tax 2025-26 Calculator by S.Seshadri |

The New Tax Regime, FY:2025-26

The new tax regime for the financial year 2025–26 offers seven tax slabs, with zero tax for income up to ₹3 lakh, and a tax rate rising by 5 percentage points for incremental income of ₹4 lakh each.

| New Income Slabs FY:2025-26(AY:2026-27) | New Tax Rates |

|---|---|

| Up to ₹ 4,00,000 | Nil |

| From ₹ 4,00,001 to ₹ 8,00,000 | 5% |

| From ₹ 8,00,001 to ₹ 12,00,000 | 10% |

| From ₹ 12,00,001 to ₹ 16,00,000 | 15% |

| From ₹ 16,00,001 to ₹ 20,00,000 | 20% |

| From ₹ 20,00,001 to ₹ 24,00,000 | 25% |

| Above ₹ 24,00,000 | 30% |

The Old Tax Regime FY 2024

As per the budget FY: 2024-25 the old tax regime the revised tax slab rates are given below. As per the new tax system up to Rs.2.5 lakhs no tax. There is no changes in old tax regime according to Budget-2024.

| Income tax slabs (Rs) | Income tax rates (%) |

| From 0 to 2,50,000 | 0 |

| From 2,50,001 to 5,00,000 | 5 |

| From 5,00,001 to 10,00,000 | 20 |

| From 10,00,001 and above | 30 |

Read Also: Seshadri Income Tax Software FY 2024-25 Click Here

Income Tax Slabs & Rates FY 2023(AY 2023-24) (< 60Years)

For Individual (resident or non-resident) less than 60 years of age anytime during the previous year.

| Existing Tax Regime | New Tax Regime u/s 115BAC | ||

|---|---|---|---|

| Income Tax Slab | Income Tax Rate | Income Tax Slab | Income Tax Rate |

| Up to ₹ 2,50,000 | Nil | Up to ₹ 2,50,000 | Nil |

| ₹ 2,50,001 – ₹ 5,00,000 | 5% above ₹ 2,50,000 | ₹ 2,50,001 – ₹ 5,00,000 | 5% above ₹ 2,50,000 |

| ₹ 5,00,001 – ₹ 10,00,000 | ₹ 12,500 + 20% above ₹ 5,00,000 | ₹ 5,00,001 – ₹ 7,50,000 | ₹ 12,500 + 10% above ₹ 5,00,000 |

| Above ₹ 10,00,000 | ₹ 1,12,500 + 30% above ₹ 10,00,000 | ₹ 7,50,001 – ₹ 10,00,000 | ₹ 37,500 + 15% above ₹ 7,50,000 |

| ₹ 10,00,001 – ₹ 12,50,000 | ₹ 75,000 + 20% above ₹ 10,00,000 | ||

| ₹ 12,50,001 – ₹ 15,00,000 | ₹ 1,25,000 + 25% above ₹ 12,50,000 | ||

| Above ₹ 15,00,000 | ₹ 1,87,500 + 30% above ₹ 15,00,000 | ||

Income Tax Slabs & Rates FY 2022-23(AY 2023-24) (60+ Years)

For Individual (resident or non-resident), 60 years or more but less than 80 years of age, anytime during the previous year.

| Existing Tax Regime | New Tax Regime u/s 115BAC | ||

|---|---|---|---|

| Income Tax Slab | Income Tax Slab Rates | Income Tax Slab | Income Tax Slab Rates |

| Up to ₹ 3,00,000 | Nil | Up to ₹ 2,50,000 | Nil |

| ₹ 3,00,001 – ₹ 5,00,000 | 5% above ₹ 3,00,000 | ₹ 2,50,001 – ₹ 5,00,000 | 5% above ₹ 2,50,000 |

| ₹ 5,00,001 – ₹ 10,00,000 | ₹ 10,000 + 20% above ₹ 5,00,000 | ₹ 5,00,001 – ₹ 7,50,000 | ₹ 12,500 + 10% above ₹ 5,00,000 |

| Above ₹ 10,00,000 | ₹ 1,10,000 + 30% above ₹ 10,00,000 | ₹ 37,500 + 15% above ₹ 7,50,000 | |

| ₹ 10,00,001 – ₹ 12,50,000 | ₹ 75,000 + 20% above ₹ 10,00,000 | ||

| ₹ 12,50,001 – ₹ 15,00,000 | ₹ 1,25,000 + 25% above ₹ 12,50,000 | ||

| Above ₹ 15,00,000 | ₹ 1,87,500 + 30% above ₹ 15,00,000 | ||

New tax regime & Old Tax regime Income Tax Slab Rates for FY 2022-23 (AY 2023-24)

| Income Tax Slab | Existing Regime Slab Rates for FY 2022-23 (AY 2023-24) | New Regime Slab Rates for FY 2022-23 (AY 2023-24) | ||

|---|---|---|---|---|

| Tax Slabs Rates Resident Individuals & HUF < 60 years of age & NRIs | Tax Slabs Rates Resident Individuals & HUF > 60 to < 80 years | Tax Slabs Rates Resident Individuals & HUF > 80 years | Tax Slabs Rates Applicable for All Individuals & HUF | |

| Rs 0.0 – Rs 2.5 lakh | NIL | NIL | NIL | NIL |

| Rs 2.5 – Rs 3.00 lakh | 5% (tax rebate u/s 87a is available) | NIL | NIL | 5% (tax rebate u/s 87a is available) |

| Rs 3.00- Rs 5.00 lakh | 5% (tax rebate u/s 87a is available) | NIL | ||

| Rs 5.00 – Rs 7.5 lakh | 20% | 20% | 20% | 10% |

| Rs 7.5 – Rs 10.00 lakh | 20% | 20% | 20% | 15% |

| Rs 10.00 – Rs 12.50 lakh | 30% | 30% | 30% | 20% |

| Rs 12.5 – Rs 15.00 lakh | 30% | 30% | 30% | 25% |

| > Rs 15 lakh | 30% | 30% | 30% | 30% |

FAQ on Income Tax

Question : What is income that is taxable in India?

Ans : In India, taxable income is any income that an individual or organization receives that is subject to income tax. It is the income received by an individual or a business less any deductions allowed by the Income Tax Act.

Question: Do men and women pay different slab rates?

Ans : No. Males and females pay the same slab rates.

Question: Is everyone’s tax return filing deadline the same?

Ans : No, different taxpayers have different deadlines for filing income tax returns. The deadline for filing the return is July 31 for Individuals & HUF who are exempt from auditing under the Income Tax Act, and September 31 for everyone else.

Question: Do various age groups have varying slab rates?

Ans : Yes. For tax payers under 60 years old, between 60 and 80 years old (senior citizens), and over 80 years old, there are different slab rates (super senior citizens).

Question: What time frame is taken into account for income tax purposes?

Ans : In India, income tax is computed annually. It is determined for the fiscal year that runs from April 1 to March 31.