Download AP, Telangana Seshadri Income Tax Software FY 2025-26(AY 2026-27)

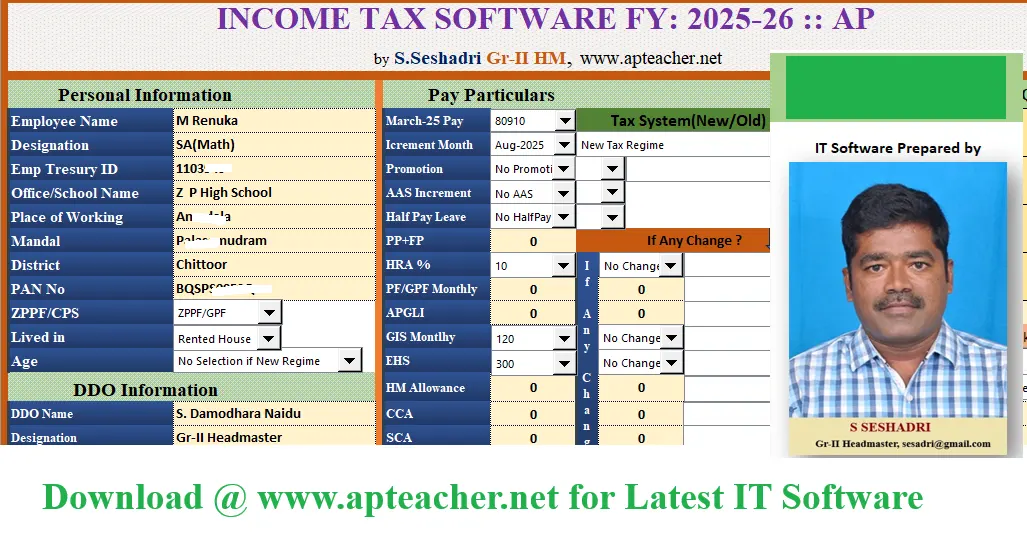

Seshadri Income Tax FY 2025-26 Software AP and Telangana : Andhra Pradesh and Telangana employees much awaiting Income Tax Software by S.Seshadri Gr-II HM has been released. This Seshadri Income Tax Software is very much useful while submitting the income tax returns to their DDO. Seshadri Income Tax Software FY:2025-26 contains Data Sheet for entering employee information, Salary sheet for full abstract of annual salary, Annexure-II for complete income tax assessment, Form(16), Rent Sheet, Form 12BB. Seshadri has developed both Online Income Tax Software and Excel Software for AP and Telangana Employees.

Updated:07/02/2026

- Income Tax Online Software by Seshadri Gr-II HM Click Here

-

Download Income Tax Software FY:2025-26(Google Drive)(Updated:07/02/2026) Click Here

-

Download Income Tax Software FY:2025-26(Server)(Updated:07/02/2026) Click Here

You can also get your AP & Telangana Employees income tax calculation online at www.ibadi.in. Salary Sheet (Annexure-I) and IT Calculation Sheet are included in income tax software (Annexure-II). The personnel of the governments of Andhra Pradesh and Telangana will find the IT 2025-26 software to be more beneficial. For the past 18 years, Seshadri SA(MM) has been publishing income tax software. He built an income tax calculation program in printable A4 format that is simple to submit to the DDO. The IT Software 2025-26 is prepared based on the latest principle laid in the IT Rules and Acts. Here, we are providing how to use Seshadri Income Tax Software FY:2025-26, special features of IT Excel Software, latest IT Slabs 2025-26, latest IT Acts and Rules are as follows.

Key Features of IT Software FY 2025-26 by Seshadri Gr-II HM

- All Sheets of Salary Sheet(Annexure-I), IT Calculation(Annexure-II) are editable, All sheets are unlocked.

- Feasible to edit anywhere in the software if needed.

- VB Script is used appropriately wherever it is necessary for user friendly use of software.

- The IT Software has the quality very few entries, more output.

- The IT Software is released in a compatible version, even works in old MS Office version.

- All prints can be taken in A4 formats and PDF formats.

Read Also : Income Tax FY:2025-26 Online Software Click Here

All Sheet of IT Excel Software in A4 Sheets

All sheets Salary Sheet(Annexure-I), IT Calculation(Annexure-II), Form 16, Rent Sheet are printable in A4 sheet. The IT Software prepared by Seshadri FY 2025-26 is enriched with VB Script to take printout easily. After taking printouts, you can submit the same to the concerned DDO.

| Annual Taxable Income | Income Tax Rate |

|---|---|

| Up to ₹4,00,000 | Nil |

| ₹4,00,001 – ₹8,00,000 | 5% |

| ₹8,00,001 – ₹12,00,000 | 10% |

| ₹12,00,001 – ₹16,00,000 | 15% |

| ₹16,00,001 – ₹20,00,000 | 20% |

| ₹20,00,001 – ₹24,00,000 | 25% |

| Above ₹24,00,000 | 30% |

Note: Health & Education Cess @ 4% is applicable in addition to the above tax rates.

Income Tax Slabs FY 2025–26 – Old Tax Regime

| Annual Taxable Income (₹) | Tax Rate |

|---|---|

| Up to ₹2,50,000 | Nil |

| ₹2,50,001 – ₹5,00,000 | 5% |

| ₹5,00,001 – ₹10,00,000 | 20% |

| Above ₹10,00,000 | 30% |

Note (Old Regime): Standard Deduction ₹50,000. Deductions like 80C, 80D, HRA, LTA allowed. Section 87A rebate available up to ₹5,00,000. Health & Education Cess @ 4% applicable.

Income Tax Rebate U/s 87A

New Regime :Salary individuals with taxable income up to Rs. 12,00,000 can receive a rebate of up to Rs. 60,000, is a significant relief. If their taxable income is less than Rs. 12,00,000/-, employees might receive a tax advantage of up to Rs. 12,500.

Old Regime : Salary individuals with taxable income up to Rs. 5,00,000 can receive a rebate of up to Rs. 12,500 according to Budget 2019 provisions. If their taxable income is less than Rs. 5,00,00/-, employees might receive a tax advantage of up to Rs. 60,000.

Income Tax Slabs FY: 2022-23

According to Section 115 BAC of the Income Tax Act, individuals and HUFs may choose either the current tax regime or the new tax regime with a lower rate of taxation. Certain Exemptions and Deductions (such 80C, 80D, 80TTB, and HRA) available under the Existing Tax Regime will not be available to the taxpayer deciding concessional rates under the New Tax Regime.

Income Tax Slabs New Regime FY:2024-25(AY:2025-26)

Here are the latest Income Tax Slabs for financial year 2024-25. The new tax regime has been made more appealing for small taxpayers with revised tax slabs and an increased standard deduction. In the 2024 Budget, Finance Minister Nirmala Sitharaman announced the following tax slabs under the new tax regime, as follows.

| Revised Income Tax Slab | Tax Percentage |

|---|---|

| Up to Rs. 3,00,000 | NIL |

| Rs. 3,00,001 to Rs. 7,00,000 | 5%(Tax Rebate u/s 87A up to Rs 7 lakh) |

| Rs. 7,00,001 to Rs. 10,00,00 | 10% |

| Rs. 10,00,001 to Rs. 12,00,000 | 15% |

| Rs. 12,00,001 to Rs. 15,00,000 | 20% |

| Above Rs. 15,00,000 | 30% |

IT Section 80C – Eligible Deductions

Following are sections and Sub sections on IT 80C

| Section in IT | Eligible investments for tax deductions |

|---|---|

| 80C | 80C allows deduction for investment made in PPF , EPF, LIC premium , Equity linked saving scheme, principal amount payment towards home loan, stamp duty and registration charges for purchase of property, Sukanya smriddhi yojana (SSY) , National saving certificate (NSC) , Senior citizen savings scheme (SCSS), ULIP, tax saving FD for 5 years, Infrastructure bonds etc |

| 80CCC Deduction for life insurance annuity plan. | 80CCC allows deduction for payment towards annuity pension plans Pension received from the annuity or amount received upon surrender of the annuity, including interest or bonus accrued on the annuity, is taxable in the year of receipt. |

| 80CCD (1) Deduction for NPS | Employee’s contribution under section 80CCD (1) Maximum deduction allowed is least of the following

|

| 80CCD (1b) Deduction for NPS | Additional deduction of Rs 50,000 is allowed for amount deposited to NPS account Contributions to Atal Pension Yojana is also eligible for deduction. |

| 80CCD (2) Deduction for NPS | Employers contribution is allowed for deduction upto 10% of basic salary plus dearness allowance under this section. Benefit in this section is allowed only to salaried individuals and not self employed. |

Interest on Savings Account Section 80 TTA

Deduction from Gross Total Income for Interest on Savings Bank Account. If you are an individual or an HUF, you may claim a deduction of maximum Rs 10,000 against interest income from your savings account.

Interest on Education Loan Section 80E

Deduction for Interest on Education Loan for Higher Studies. A deduction is allowed to an individual for interest on loans taken for pursuing higher education. This loan may have been taken for the taxpayer, spouse or children or for a student for whom the taxpayer is a legal guardian.

Income Tax Software by Seshadri FY:2024-25

- Download AP Income Tax Software FY:2024-25(GoogleDrive): Click Here

- Download AP Income Tax Software FY:2024-25(Server): Click Here (Use Mozilla Firefox Browser)

- Online Andhra Pradesh Income Tax Software FY:2024-25 Click Here

Income Tax Software by Seshadri FY:2023-24

- #1 Download AP Income Tax Online Software FY:2023-24: Click Here

- Download AP Income Tax Software FY:2023-24GoogleDrive: Click Here

- Download AP Income Tax Software FY:2023-24: Click Here(Use MozillaFirefox Browser)

Income Tax Software by Seshadri FY:2022-23

-

Download Seshadri IT Software Excel(Google Drive) Updated:01/02/2023 Link 1 Click Here

-

Download Seshadri IT Software Excel FY:2022-23 Updated:01/02/2023 Link2 Click Here (Note : Use Mozilla Browser to Download Income Tax Software)

-

AP Income Tax 2022-23 Online Software by Seshadri Click Here

-

Telangana Income Tax FY 2023 Online Software by Seshadri Click Here

Download Income Tax Seshadri Software 2022-23

| Download Link 1 Click Here | Download Link 2 Click Here |