Download Income Tax Ramanjaneyulu for AP and Telangana FY:2025-26

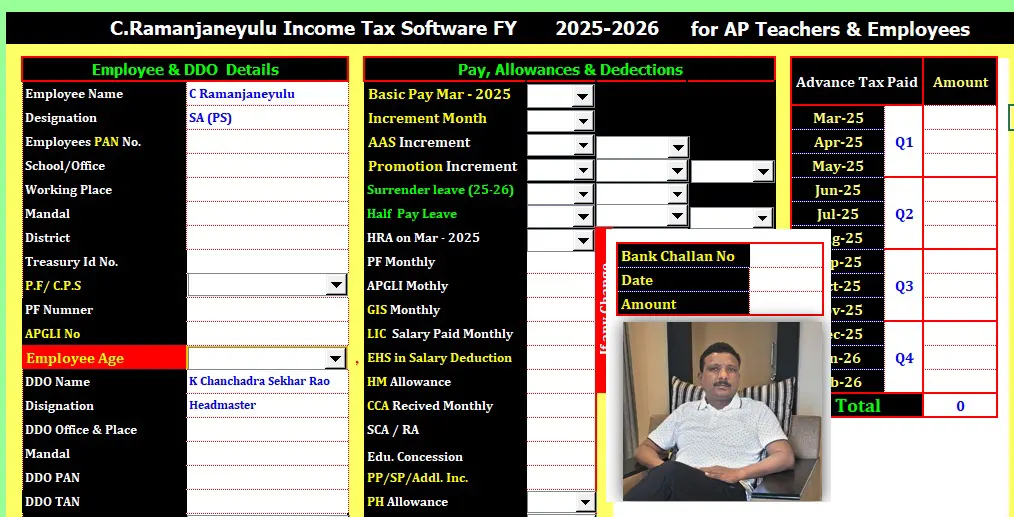

Ramanjaneyulu Income Tax 2025-26 Software: Latest Income Tax Software FY 2025-26 of Ramanjaneyulu, has been launched. Ramanjaneyulu Income Tax software is one of the most well-known and is placed in the first row. He prepares income tax returns for the states of Andhra Pradesh and Telangana every year. This is year also he prepared Excel Income Tax Software on par with Seshadri Income Tax Software Excel, Seshadri Online Income Tax Software, KSS Income Tax Software This financial year also FY:2025-26 he released income tax software. Here, we are proving the Ramanjaneyulyu Income Tax Software, FY:2025-26.

Read Also

- Seshadri Online Income Tax Software for AP A4 Printable Click Here

- Seshadri Excel Income Tax Software FY 2025-26(AY : 2026-27) Click Here

He prepared income tax software for both Telangana and Andhra Pradesh. He is highly interested about creating income tax software in Excel which is useful to all AP and Telangana Govt. Employees. His remarkable effort and command of MS Excel made him well-known. While conversing with others, he maintains a relaxed demeanor. When interacting with others, he is a pleasant guy. His income tax software is comparable to Seshadri Income Tax Software Online and Seshadri Offline Excel Software, Jayaram Income Tax Software and KSS Prasad IT Software. His income tax includes a Data Sheet, Annexure-I. (Salary Sheet), Form-16, Month wise Rent Receipt.

-

Download Ramanjineyulu Income Tax Software 2025-26 Click Here

Overview of Ramanjaneyulu Income Tax Software FY:2025-26

| Name of the Article | Ramanjaneyulu Income Tax Software FY:2025-26 |

| State | Andhra Pradesh |

| Name of the software | Income Tax Excel Software |

| Useful for | To Calculate tax of AP Employees |

| Software Designer | Ramanjaneyulu SA(PS) |

| Financial Year | 2025-26 |

| Assessment Year | 2026-27 |

| KSS Prasad Software available at | www.apteacher.net |

| Forms available at software | Annexure-II, Salary Form, Form16, Rent Slip |

Ranajaneyulu IT FY:2025-26 Software has All Forms

The sheets which are present in his Income Tax Software Salary Sheet (Annexure-I), Income Tax Calculation Sheet (Annexure-II) are all in A4 and Printable. His software also has FORM-16, Rent Receipt. He appropriately mentioned every field in his IT Form, one can be easily understood.

Download Income Tax Software of Ramanjaneyulu

Ramanjaneyulu IT Software is available for download by AP government employees at the following link. After downloading the software, the data must be carefully entered into the Data Sheet. Employee Personal Details, Salary Details, 80C Deductions with Specified Limits, and Exceeding 80C Deductions such as Home Loan Interest, Education Loan Interest, EWF, SWF are all included on the data sheet.

Things to Consider When Preparing Your Income Taxes

Before beginning to fill out the data sheet, it is recommended that you first read the instructions on the welcome sheet certain way to fill all fields. The welcome sheet clearly stated how to use the IT Excel Software. In the welcome page, he requests that users use the original copy of Income Tax Software and not use it more than once.

Ramanjaneyulu Software is More Beneficial to AP Government Employees

Salaried AP Government employees may easily utilize his Income Tax Software. After filling out the data with basic pay, increments, and 80C deductions, take printouts on A4 sheets and submit them to the DDO, who is responsible for deducting income tax.

Ramanjaneyulu IT Software Unique features

- Data Sheet is more user-friendly and clearly.

- The data fields are arranged in a hierarchical fashion.

- To make it easier to use, required fields have a white background.

- Annexure-I, Annexure-II, Form-16, and Rent Receipt are all in A4 format and may be printed.

- There is room for advance tax deductions.

New Tax Regime Income Tax Slabs FY 2025-26 (AY 2026-27)

The New Tax Regime introduced by the Government of India continues for the Financial Year 2025-26. This regime offers lower tax rates with fewer exemptions and deductions, making it simpler for salaried employees and teachers in Andhra Pradesh.

New Tax Regime Slabs FY 2025-26 (AY 2026-27)

The Government of India has revised the New Tax Regime income tax slabs for the Financial Year 2025-26. These slabs apply to individuals opting for the new tax regime under Section 115BAC.

New Tax Regime Income Tax Slabs 2025-26

| Taxable Income | Income Tax Rate |

|---|---|

| Up to ₹4,00,000 | Nil |

| ₹4,00,001 – ₹8,00,000 | 5% |

| ₹8,00,001 – ₹12,00,000 | 10% |

| ₹12,00,001 – ₹16,00,000 | 15% |

| ₹16,00,001 – ₹20,00,000 | 20% |

| ₹20,00,001 – ₹24,00,000 | 25% |

| Above ₹24,00,000 | 30% |

Standard Deduction under New Tax Regime

Salaried employees and pensioners are eligible for a standard deduction of ₹75,000 under the new tax regime.

Section 87A Rebate – New Tax Regime

Under Section 87A, resident individuals with taxable income up to ₹12,00,000 are eligible for a tax rebate of up to ₹60,000. This can reduce the income tax payable to zero.

Zero Tax Limit under New Tax Regime

Due to the combination of:

- Standard Deduction of ₹75,000, and

- Section 87A rebate up to ₹60,000,

a salaried individual can earn up to approximately ₹12.75 lakh and still pay no income tax under the new tax regime.

Important Notes

- The New Tax Regime is the default regime while filing Income Tax Returns

- Health & Education Cess @ 4% applies on tax payable

- Surcharge applies as per income limits

- Most exemptions and deductions are not available under the new regime

Taxpayers, especially teachers and government employees, are advised to compare tax liability under both old and new regimes before making a choice.

Income Tax Slabs 2024-25

The New Tax Regime FY:2024-25

The new tax regime offers six tax slabs, with zero tax for income up to ₹3 lakh, and a tax rate rising by 5 percentage points for incremental income of ₹3 lakh each.

New Tax Regime Slabs FY 2024-25

| Income tax slabs (Rs) | Income tax rate (%) |

|---|---|

| From 0 to 3,00,000 | 0 |

| From 3,00,001 to 7,00,000 | 5 |

| From 7,00,001 to 10,00,000 | 10 |

| From 10,00,001 to 12,00,000 | 15 |

| From 12,00,001 to 15,00,000 | 20 |

| From 15,00,001 and above | 30 |

The Old Tax Regime, FY 2024-25

The income tax slabs were not tweaked for the old tax regime for FY 2023-24 and remain as below.

| Total Income | Tax Rate |

| Up to ₹ 2,50,000 | 0%₹ |

| ₹ 2,50,000 to ₹ 5,00,000 | 5% |

| ₹ 5,00,000 to ₹ 10,00,000 | 20% |

| Above ₹ 10 lakh | 30% |

Other Popular Income Tax Software

- Download Income Tax Software of C Ramanjaneyulu 2024-25 Click Here

- Seshadri Online Income Tax Software FY 2024-25 Click Here

- Seshadri Online Income Tax Software FY 2023-24 Click Here

- Seshadri Income Tax Software FY 2022-23(AY : 2023-24) Click Here

- KSS Prasad Income Tax Software FY 2023-24 Click Here

- KSS Prasad Income Tax Software FY 2022-22 Click Here

FAQ on Ramanjaneyulu Income Tax FY 2025-26

Question: Where can I download Ramanjaneyulu Income Tax Software ?

Ans: Ramanjaneyulu Income Tax Excel software FY:2025-26 can download from www.apteacher.net.

Question: Is it useful to new tax regime and old tax regime ?

Ans: Yes, It’s useful for both New Tax Regime and old Tax Regime.

Question: Is the Ramanjaneyulu Income Tax Software is mobile friendly ?

Ans. Ramanjaneyulu Excel software is not mobile friendly. It works on Laptop or Desktop computers. For mobile friendly software, you can use seshadri income tax online software.

Question: What are the forms available in KSS Prasad Income Tax Software ?

Ans: Salary Sheet, IT Calculation Form, Form-16 in printable form.

Question: Is option available for Below 6o years age, Above 60 years Age in old regime ?

Ans. Yes, Both options available at Ramanjaneyulu Income Tax Software, FY:2025-26. As per the new IT Slabs, there is no option for it.

Thanks for your write-up. Another issue is that just being a photographer will involve not only difficulty in capturing award-winning photographs but hardships in establishing the best video camera suited to your needs and most especially hardships in maintaining the quality of your camera. This can be very correct and clear for those photography lovers that are in capturing the particular nature’s interesting scenes — the mountains, the forests, the actual wild or seas. Visiting these adventurous places unquestionably requires a digital camera that can meet the wild’s nasty landscapes.