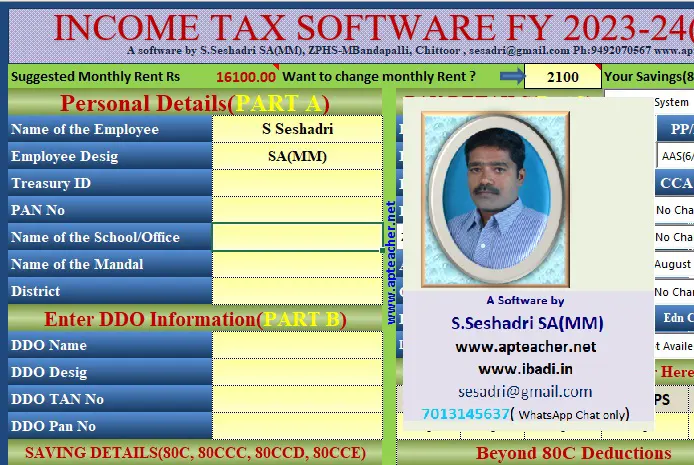

Seshadri Income Tax(IT FY 2023-24) Software for AP Govt. Employee’s

Here we are providing Income Tax Software FY 2023-24 Online and Excel of S.Seshadri, who has 15 years of experience in preparing income tax software. In addition to the Seshadri Income Income tax Software, here we are providing Ramanjaneyulu, KSS Prasad, K Vijya Kumar, BS Chari, Jayaram Income Tax Software excel programs. Seshadri Online Income Tax software is very easy to use, is downloadable and save in local system.

-

Income Tax FY:2023-24 Online Software by Seshadri Click Here

-

Income Tax Excel Software FY 2023-24(AY:2024-25) by Seshadri Click Here

List of Income Tax Software for AP Employees to Download

Employees of Andhra Pradesh can download various Income Tax software products given below and make use of it.

| S No | Name of the Income Tax Software, FY 2023-24 | Updated On | Download Link |

|---|---|---|---|

| 1 | #1 Seshadri Income Tax Online Software | 15/01/2024 | Click Here |

| 2 | Seshadri Income Tax Software Excel | 17/01/2024 | Click Here |

| 3 | M Jayaram Income Tax Software(Final) | 10/01/2024 | Click Here |

| 4 | C Ramanjaneyulu Income Tax Software | 13/12/2023 | Click Here |

| 5 | K Vijaya Kumar Income Tax Software | 02/01/2023 | Click Here |

| 6 | KSS Prasad Income Tax Software | 05/01/2024 | Click Here |

| 7 | B.S Chari Income Tax Software | 05/01/2024 | Click Here |

| 8 | Ch Nagendra Income Tax Software | 10/01/2024 | Click Here |

Previous Year Income Tax Software FY:2021-22 by Seshadri

Income Tax FY:2021-22 Online Software by Seshadri Click Here

Download Seshadri Income Tax Software FY 2021-22(AY 2022-23) for AP Employees (Click Here)

Income Tax Software 2022-23 by Seshadri SA(MM)

AP Income Tax 2023-24 Calculation Software has been released by Seshadri SA(MM). The AP Income tax software for AP employees and Telangana Employees is available in both online and excel formats. The online income tax is available at www.ibadi.in income tax software Salary Sheet(Annexure-I), IT Calculation Sheet(Annexure-II). The IT software is more useful to the employees of Andhra Pradesh and Telangana Govt employees. Seshadri SA(MM) has been preparing Income Tax software for the past 15 years. The Income Tax Calculation Software prepared by him is A4 printable and easy to submit the same to the DDO. The IT Software is prepared based on the latest principle laid in the IT Rules and Acts.

Various Special Feature of IT Software FY 2023-24 by Seshadri

- Salary Sheet(Annexure-I), IT Calculation(Annexure-II) are editable, no cells are locked

- Can edit anywhere in the software if needed.

- Used VB Script appropriately wherever is necessary.

- With very few entries, more output.

- It is a compatible version, even works in old MS Office.

- All prints can be taken in A4 formats.

All Pages of IT Software in A4 Sheets.

The IT Software by Seshadri FY 2021-22 is enriched with VB Script to take printout easily. Once you take all printouts you can submit the same to the concerned DDO.

Tax Rebate U/s 87A is Rs.12,500

The salaried employee, who has taxable income is up to Rs.5,00,000/- can avail the rebate up to Rs.12,500/- as per the provisions available in the Budget 2019. Employees can avail upto Rs.12,500 tax benefit who’s taxable income is below Rs.5,00,00/-.

Tax Rebate U/s 87A Up to Rs.50,000/-

In Budget 2019, Rs.50,000 standard deduction, a fixed amount, that helps to reduce tax burden to salaried persons as well as pensioners. This standard deduction is not useful to family pensioners. For the tax purpose, one can reduce Rs.50,000 from their gross salary.

The New Tax Regime FY:2023-24

The new tax regime offers six tax slabs, with zero tax for income up to ₹3 lakh, and a tax rate rising by 5 percentage points for incremental income of ₹3 lakh each.

| On Income | Tax Rate |

| Up to ₹ 3,00,000 | Nil |

| From ₹ 3,00,001 to ₹ 6,00,000 | 5% |

| From ₹ 6,00,001 to ₹ 9,00,000 | 10% |

| From ₹ 9,00,001 to ₹ 12,00,000 | 15% |

| From ₹ 12,00,001 to ₹ 15,00,000 | 20% |

| Above ₹ 15,00,000 | 30% |

The Old Tax Regime FY 2023-24

The income tax slabs were not tweaked for the old tax regime for FY 2023-24 and remain as below.

| Total Income | Tax Rate |

| Up to ₹ 2,50,000 | 0%₹ |

| ₹ 2,50,000 to ₹ 5,00,000 | 5% |

| ₹ 5,00,000 to ₹ 10,00,000 | 20% |

| Above ₹ 10 lakh | 30% |

Latest Income Tax Slabs FY 2022-23 (AY 2023-24)

| Resident (Age below 60 Yrs.) | Senior citizen (60 Years and Above) | Income Tax rates |

| Up to Rs 2,50,000/- | Up to Rs 3,00,000/- | NIL |

| Rs 2,50,001–5,00,000/- | Rs 3,00,001–5,00,000/- | 5% |

| Rs 5,00,001–10,00,000/- | Rs 5,00,001–10,00,000/- | 20% |

| Above Rs 10,00,000/- | Above Rs 10,00,000/- | 30% |

Tax Exemption Provisions Under U/s 80C IT Act FY 2023-24

| 1 | Repayment of Home Loan principle | Max Rs 1,50,000/- |

| 2 | LIC Insurance Premium- Annual | Max Rs 1,50,000/- |

| 3 | Tuition Fee- Two Children | Max Rs 1,50,000/- |

| 4 | National Savings Certificates (NSC) | Max Rs 1,50,000/- |

| 5 | Unit linked Insurance Plan | Max Rs 1,50,000/- |

| 6 | Equity linked Savings Schemes (ELSS) | Max Rs 1,50,000/- |

| 7 | 5-Years fixed deposits with bank/post office | Max Rs 1,50,000/- |

| 8 | Public Provident Fund | Max Rs 1,50,000 /- |

| 9 | ULIP Fund | Max Rs 1,50,000 |

| 10 | PLI | Max Rs 1,50,000 |

Beyond 80C Deductions and Max Value

| Deduction Name | Max Value Rs. |

| 80CCD(1B)-National Pension Scheme (For Non CPS) | 50000 |

| 80TTA-Intrest on Saving Account (Not Fixed Deposit ) | 10000 |

| 80EEB-Interest of Purchase Of Electric Vehicle | 150000 |

| 80E-Interest of Educational Loan 80E | 1000000 |

| 80EE-Interest of Housing Loan 80EE | 50000 |

| 80EEA-Interest of HBA Loan 80EEA | 150000 |

| 80EEB-Interest of Purchase Of Electric Vehicle | 150000 |

| 80D-Medical Insurance Self, Spouse & Children | 25000 |

| 80CCG-Rajiv Gandhi Equity Saving Scheem | 25000 |

| 80D-Medical Insurance Family & Parents (< 60) | 50000 |

| 80D -Medical Insurance Family (< 60) but Parents (>60) | 75000 |

| 80D-Medical Insurance Family & Parents (>60) | 100000 |

| 80DDB-Medical Treatment of Specified Diseases (<60) | 40000 |

| 80DDB-Medical Treatment of Specified Diseases (>=60) | 100000 |

| 80DD-Dependent Disabled Person (< 80% ) | 75000 |

| 80DD-Dependent Disabled Person (> 80% ) | 100000 |

| 80U-Physically Disabled Assesse (Below 80% ) | 75000 |

| 80U-Physically Disabled Assesse (Above 80% ) | 125000 |

| 80G-Donation of Charitable Institution-50% | 500000 |

| 80G-Donation of Charitable Institution-100% | 250000 |

| 80G-Donation on certain specified funds-100% | 500000 |

| 80G-Payments Made to Electoral Trusts-100% | 500000 |

Download Various Income Tax Softwares

- Seshadri Online Income Tax Software for AP A4 Printable Click Here

- Seshadri Online Income Tax Software for Telangana A4 Printable Click Here

- Seshadri Income Tax Software for AP Excel Software Click Here

- Seshadri Income Tax Software for Telangana Excel Software Click Here

- Complete information about 80C, 80CCC, 80CCD, 80CCF Click Here

- Read more about EPF/VPF, PPF, NSC POTD, SCSS, 80CCD, ELSS, ULIP Click Here

- KSS Prasad Income Tax Software FY 2021-22 Click Here

- Seshadri Income Tax Software FY 2021-22(AY : 2022-23) Click Here

- AP Govt. Employees Online Income Tax Calculation Click Here

- C Ramanjineyulu Income Tax Software Click Here

Pingback: TS Income Tax Software FY:2021-22 for Telangana Employee – Teachers Badi – TSBADI