Income Tax Deductions of Chapter VI A Exemptions, Deductions

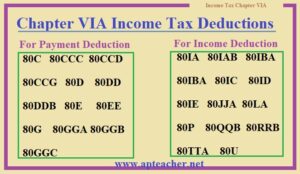

Chapter VI A of Income Tax covers deductions made under section 80C to Section 80U. Here we are discussing about what are the possible deductions under Chapter VI A which reduces tax burden on taxpayer. If the individual income increases, they end up with higher taxes. Those who fall under low to medium tax income can save considerable amount of money by using Chapter VI A multiple options.

What is Income Tax Act Chapter VI A ?

According to Chapter VIA of the Income Tax Act, a person may deduct certain types of tax-saving investments, allowable expenses, charitable contributions, etc. from their income. The deductions allowed by Chapter VIA are intended to help the taxpayer and lessen their tax liability. Deductions made under 80C, 80CCC, 80CCD, 80CCE, 80D, 80U are big relief to the taxpayer which are comes under IT Act Chapter VI A. Chapter VI A helps not only save and invest money, but also save taxes.

Read Also : Income Tax Slab Rates FY 2022-23(AY 2023-24) Click Here

Chapter VIA IT Deductions

The sections which helps to reduce the taxes significantly to Individual and HUF taxpayers are given below.

80C Deductions Chapter VIA

To take advantage of Section 80C, the taxpayer must invest and make certain payments as follows:

- Life Insurance Premium

- Contribution to Public Provident Fund (PPF)

- Contribution to Recognized Employee Provident Fund (EPF)

- Investment in National Pension Scheme (NPS)

- Investment in National Savings Certificate (NSC)

- Investment in Equity Linked Saving Scheme (ELSS)

- Investment in Unit Linked Insurance Plan (ULIP)

- Investment Tax Saving Fixed Deposit (five-year fixed deposit (FD) of Scheduled Bank or Post Office)

- Contribution to Approved Superannuation Fund

- Senior Citizen Saving Scheme

- Sukanya Samriddhi Yojana

- Repayment of Housing Loan Principal amount

- Tuition Fees of any college, school, university or other educational institutions within India for full-time education for maximum 2 children.

Section 80CCC Deductions

Individuals who have paid or deposited any amount in a specified pension funds that are offered by a life insurance. HUF (Hindu Undivided Family) is not eligible for exemption under Section 80CCC. These provisions apply to both residents as well as non-residents individuals.

The following amounts will be taxable during the year they are received:

- Income from an annuity or pension.

- The amount received when surrendering an annuity, including any accrued bonus or interest.

Note: No deductions can be claimed under Section 80C if a deduction is claimed under this section.

Section 80CCD Deductions

The government of India has notified deductions for contributions to pension schemes. The deductions fall into three categories ie 80CCD(1), 80CCD(1B), 80CCD(2)

80CCD(1): An individual who deposits into his or her pension account as per National Pension Scheme or the Atal Pension Yojana, whether he or she is salaried or self-employed. It’s a contribution of employee.

80CCD(1B) : Individual taxpayer who have deposited the money in the National Pension Scheme will have an additional deduction.

80CCD(2): Contributions made by the employer to the pension account of the employee. A deduction u/s 80CCD(2) may be made after the employer’s contribution is included in the employee’s salary.

Section 80CCE Deduction

The maximum permittable deduction of Rs. 1, 50,000 under section 80C, 80CCC, and 80CCD(1). The division is as shown below.

- 80C Special Investment ceiling limit Rs.1,50,000/-

- 80CCC Contribution to certain pension funds ceiling limit Rs.1,50,000/-

- 80CCD(1) Contribution to NPS of Government

- 80CCE Aggregate Deduction under above sections ceiling Rs.1,50,000/-

- 80CCD(1B) Contribution of NPS of Central Government Ceiling Rs.50,000/-

- 80CCD(2) Contribution by employer to Central Govt NPS ceiling 10% of salary.

Section 80D Deductions

The expenditure should be incurred in Health insurance premium or Mediclaim premium,Contribution to Central Government Health Scheme, Preventive health checkup, Medical expenditure (only applicable in case of a Very Senior Citizen/ senior citizen (aged 60 years or above) not having a medical insurance)

Amount of Deduction under Section 80D

- For Individuals paying for Self, Spouse and Dependent Children below 60 years: Rs. 25,000.

- For Individuals paying for Self, Spouse and Dependent Children above 60 years: Rs. 50,000.

Section 80DD Deductions

Expenditures should be made in Medical treatment, nursing care, training, and rehabilitation should be paid for a dependent with a disability. Deduction is allowed for a dependent of the taxpayer and not the taxpayer himself.

The amount of deduction is Rs. 75,000 (Where disability is 40% or more but less than 80%). In case of severe disability (person with 80% or more disability), the amount of deduction will be Rs. 1,25,000.

Section 80DDB Deductions

A prescription for such medical treatment must be provided by a neurologist, an oncologist, a urologist, a hematologist, an immunologist, or any other specialist specified by the taxpayer. In the case of a senior citizen and super-senior citizen, Rs.1,00,000 or amount actually paid, whichever is less.

Section 80E Deduction

The loan must have been taken for the higher education of self or relative. Deduction should be a total of 8 years or repayment in full, whichever comes first. No maximum or minimum deduction limit specified under section 80E. This section provides a deduction on the actual interest amount paid during the financial year.

Section 80EE Deduction

Following conditions has to meet to avail tax benefit under 80EE. The conditions are

- A taxpayer has taken out a loan for his first home, meaning – s/he does not own a house when a housing loan is approved.

- The loan is sanctioned in FY 2016-17 and 2017-18.

- The House is not worth more than Rs. 50,00,000.

- The loan amount sanctioned does not exceed Rs. 35,00,000.

- Under this section, the deduction of housing loan interest cannot be taken under any other section.

- 80EE deduction is in addition to the deduction available under section 24 while computing ‘income from house property.

The interest paid on the housing loan is up to Rs.50,000/-

Section 80EEA Deduction

Following conditions has to meet to avail tax benefit under 80EEA. The conditions are

- A taxpayer has taken out a loan for acquiring a residential unit and he/she does not own a house as on the date of loan sanction.

- The loan is sanctioned between April 1, 2019 to March 31, 2022.

- Stamp Duty Value of the house should not exceed 45,00,000.

- 80EEA deduction is in addition to the deduction available under section 24 while computing ‘income from house property.

Maximum amount of deduction, interest paid on the Housing Loan is up to Rs.1,50,000/-

Section 80EEB Deduction

- Purchase of Electric vehicles.

- Loan is taken from any financial institution between April 1, 2019 to March 31, 2023.

- Interest paid on the Loan is up to Rs.1,50,000.

Section 80G Deduction

- Donations to funds like Prime Minister’s National Relief Fund, The National Children’s Fund, etc.

- Donations to the following:

- The Jawaharlal Nehru Memorial Fund,

- Prime Minister’s Drought Relief Fund,

- Indira Gandhi Memorial Trust,

- Rajiv Gandhi Foundation.

- Donation to Government or any approved local authority for the promotion of Family Planning.

- Donations to Charitable institutions who provide a certificate.

Section 80TTA Deduction

Interest income on deposits in Savings Bank Accounts of Banks, Co-Operatives Banks or Post Office.The amount of deduction, the amount of interest earned or Rs. 10,000, whichever is less. The deduction does not apply to interest on bonds, partner’s capital, FD interest, sweep TD interest, etc.

Section 80TTB Deduction

Interest income on deposits in Savings Bank Accounts of Banks, Co-Operatives Banks or Post Office, banking company, cooperative, society engaged in the banking business etc. The amount of deduction, the amount of interest earned or Rs. 50,000, whichever is less.

Section 80U Deduction

When filing an income tax return, the taxpayer should provide a copy of the certificate issued by the appropriate medical authority. Rs. 75,000 is the amount of deduction (having a disability of 40% or more). If the person has 80% or more disability, the deduction will be Rs. 1,25,000. It is a fixed deduction and is not based on actual expenses.